Subprime personal loan lenders

Fannie Mae is short for the Federal National Mortgage Association one of two government-sponsored enterprises GSE that provides lenders with the cash needed to fund home loans with affordable mortgage ratesIn turn lenders use the cash raised selling mortgages to Fannie Mae to fund new loans which adds stability to the US. Loans come at a cost which includes the interest rate and any.

Pin On Financial Services

Reputable lenders typically dont operate in this way.

. As a result of the borrowers lower credit. To qualify for the Home Possible loan with reduced PMI rates most lenders will require a 660 or better credit score. In the first half of this year lenders mailed a record 126 billion solicitations for these loans according to market-research firm Competiscan.

When shopping for a personal loan for bad credit these are the most important things to consider when comparing lenders. Potential lenders will review your loan request and if you meet their lending criteria will make an offer. You could get a loan with a credit score as low as 600 which is in the range of fair credit.

In the second quarter of 2022 total loans and leases taken out by all subprime borrowers. Check the collateral criteria. This directory of direct tribal loan lenders is updated every few weeks and we.

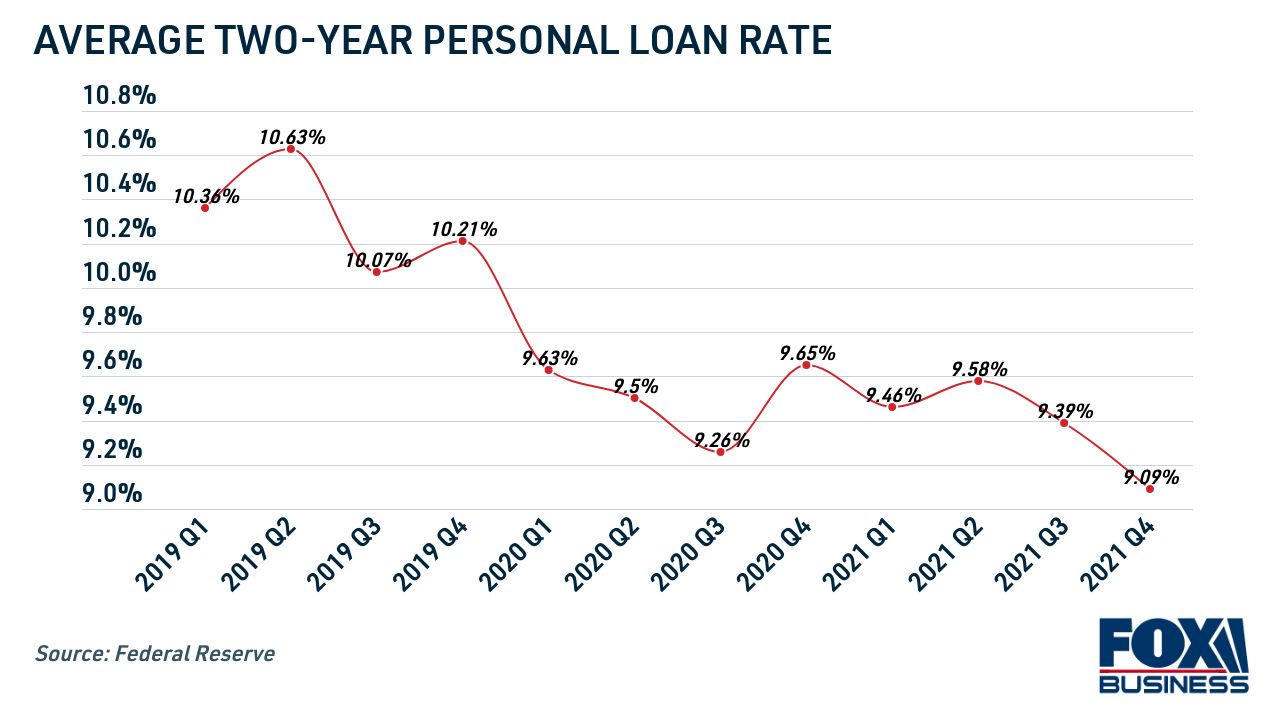

Personal loan rates currently range from around 4 to 36 depending on the lender borrower creditworthiness and other factors. Plain Green Loans is an online lender that offers short-term loans to underbanked and subprime consumers with emergency cash needs. Some lenders use FICOs competitor VantageScore which puts subprime scores between 300 and 600.

A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 403 or better or a used-car loan around 553 or lower. The average auto loan rate for a new car was 407 in the first quarter of 2022 while the typical used-car loan carried an interest rate of 862 according to Experians State of the Automotive. Fewer subprime borrowers.

A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property. CreditLoan is a trusted online lending network that offers personal loan options ranging from 250 to 5000 for folks with less-than-perfect credit scores. How to get a secured personal loan.

Stay clear of lenders who promise that your loan will be approved regardless of your credit history or rating. The Late 2000s Subprime Housing Crisis. Many lenders that offer secured loans will have eligibility standards for what theyll accept as.

Beware of loan offers through the mail via telephone or door-to-door solicitations. As the economy continued to grow many mortgage lenders became brash and overly confident about extending credit. While each lender is different lenders typically follow similar processes for how consumers can apply for a loan.

Most lenders have online personal loan applications but your local bank or credit. Subprime borrowers fall between 501 and 600 according to Experian. The company offers short-term personal loans ranging from 300 to 800 for individuals with less-than-perfect credit scores.

Around the early 2000s these lenders began offering conventional mortgages to high. Make sure any lender you work with is licensed. What is Fannie Mae.

The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. Most lenders require a minimum credit score of 580 and a 35 down payment for an FHA loan but you could qualify with a credit score between 500 and 579 and a 10 down payment. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral.

Many personal loan lenders advertise low APRs. According to the Wall Street Journal in 2019 lenders started sending more personal loan direct mail pieces than credit card application mail pieces. Heres what you need to do to get a secured personal loan.

While interest rates are not the only costs associated with taking. Applying for an online personal loan with CreditLoan is free quick and easy. A subprime mortgage is a type of mortgage that is normally issued by a lending institution to borrowers with low credit ratings.

Credit score Average APR. Why LendingPoint is best for subprime borrowers.

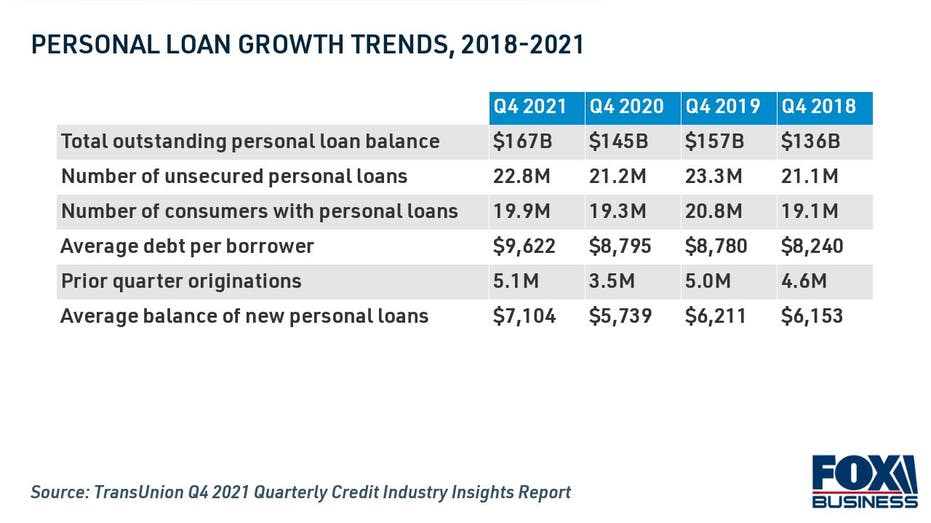

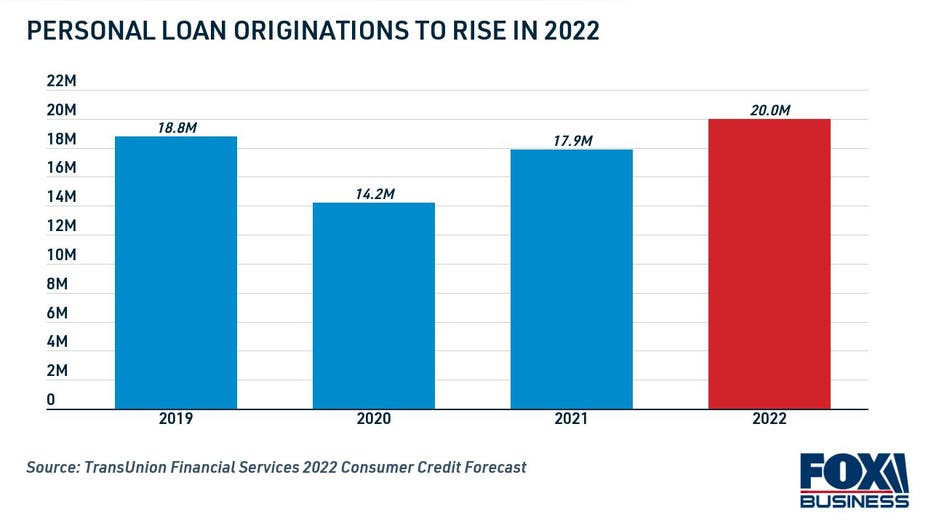

Personal Loan Lenders Will Accept More Subprime Borrowers In 2022 Transunion Says Fox Business

![]()

Best Personal Loans Alberta Loans Canada

Personal Loan Personal Loans Banks Ads Photo Album Layout

Personal Finance How To Improve Your Credit For A Mortgage Atlantic Bay Mortgage Group Mortgage Improve Yourself Understanding Yourself

Best Bad Credit Loans In Canada 2022 Secured Unsecured

Marriage Is An Important Milestone In Everyone S Life Many People Especially Girls Dream Of Having A Fairy T Payday Loans Online Payday Loans Personal Loans

Personal Loan Lenders Will Accept More Subprime Borrowers In 2022 Transunion Says Fox Business

9 Best Personal Loans In Canada Reviewed In 2022

7 Easiest Personal Loans To Get 2022 Badcredit Org

Personal Loan Lenders Will Accept More Subprime Borrowers In 2022 Transunion Says Fox Business

Get 60 Month Car Loans Guaranteed Approval At Affordable Rates From Carloansbadcredithistory Com Apply Online For Instant App Car Loans Car Finance Loan Rates

Wuj Trc0hdmq0m

Large Unsecured Personal Loans With Good Credit Loans Canada

Best Personal Loans Of September 2022 Forbes Advisor

Asset Backed Securities Abs An Umbrella Term Used To Refer To A Kind Of Security Which Derives Its Value From A Pool Of Asse Asset Personal Loans Car Loans

Direct Private Lenders For Personal Loans Loans Canada

Personal Loan Lenders Will Accept More Subprime Borrowers In 2022 Transunion Says Fox Business